How Much Can You Finance on a New Car

Read through our tips and advice before taking those new car keys.

Thianchai sitthikongsak/Getty ImagesNo, the headline does not mislead you. As of this past September, data showed the average new car now costs $45,000. While there's reasons that's happening related to supply chain problems, it may be awhile before car prices fall a little closer back down to Earth. Regardless, if you can't finance that kind of money, you don't need to worry, no matter the market conditions. Even if you have to skip on those comfier seats or bigger touchscreen, it's the smart decision.

It takes more than looking at a car's MSRP to understand if you can afford it, though. Most of us plan budgets monthly, so we'll walk through how to see if a car payment works for you. Read on for our tips and advice to make sure you don't overspend on a new or used car. That way, when you sign the papers, you can drive home with your new car knowing you made the best decision possible.

Setting a monthly number

It might seem obvious, but the first step to figuring out how much you can spend on your new car is to calculate your monthly budget. Add up all your monthly income, subtract expenses (everything from rent or mortgage payments to food and healthcare), and see how much is left. For your benefit, the Federal Trade Commission even offers a sample budget sheet online.

But don't dedicate every last penny of disposable income to a car. Instead, experts have developed some guiding rules for how much is reasonable to spend.

In the past, advisers sometimes recommended what was called the 20/4/10 rule: make a 20% down payment, have a loan lasting no longer than four years and don't let payments exceed 10% of your gross income. But those figures aren't realistic for today's shoppers. In part that's because car loans last much longer: In March 2020, the average auto loan surpassed 70 months, according to Edmunds research.

Today, experts generally recommend spending no more than 15% of your monthly take-home pay (that's how much you receive after taxes and other deductions). Depending on your budget, spending closer to 10% might be a more reasonable guideline.

Based on those rules, somebody with a take-home income of $3,000 per month might consider a payment of $300 to $450 per month, figures that represent 10% and 15% of their take-home pay, respectively. If you're not looking at a fancy SUV or pickup truck, that's generally a good number when shopping for more affordable new cars.

However, it's important to note that you're responsible for more than just the car payment. Factor in insurance costs, too, when figuring out your total monthly car expenditure. Don't let the combined cost of insurance and the car's payment exceed the rule you've set for yourself, whether that's 15% or some other value. For that reason, picking a base car payment closer to 10% to 15% of your take-home income is a safer rule to ensure you won't blow your budget.

For this reason, many advisers instead recommend setting a limit for how much your total car expenses will be per month. For instance, you might decide to spend no more than 15% of your total take-home pay on your loan payment, insurance and gas costs combined. That can be an especially important rule for buyers who already have other debts.

Your monthly payment can vary significantly depending on your credit score, the length of your loan and the size of your down payment.

AudiCalculating the monthly payment

Once you know how much you can afford to spend, it's time to work out how much you'd pay for the car you want. New car ads and review sites generally list only the total MSRP (manufacturer's suggested retail price), so you'll need to convert that to a monthly figure. Most carmakers offer a loan calculator on their consumer websites. Simply input data like your potential down payment and interest rate, and the site's calculator will tell you approximately how much the loan would cost per month.

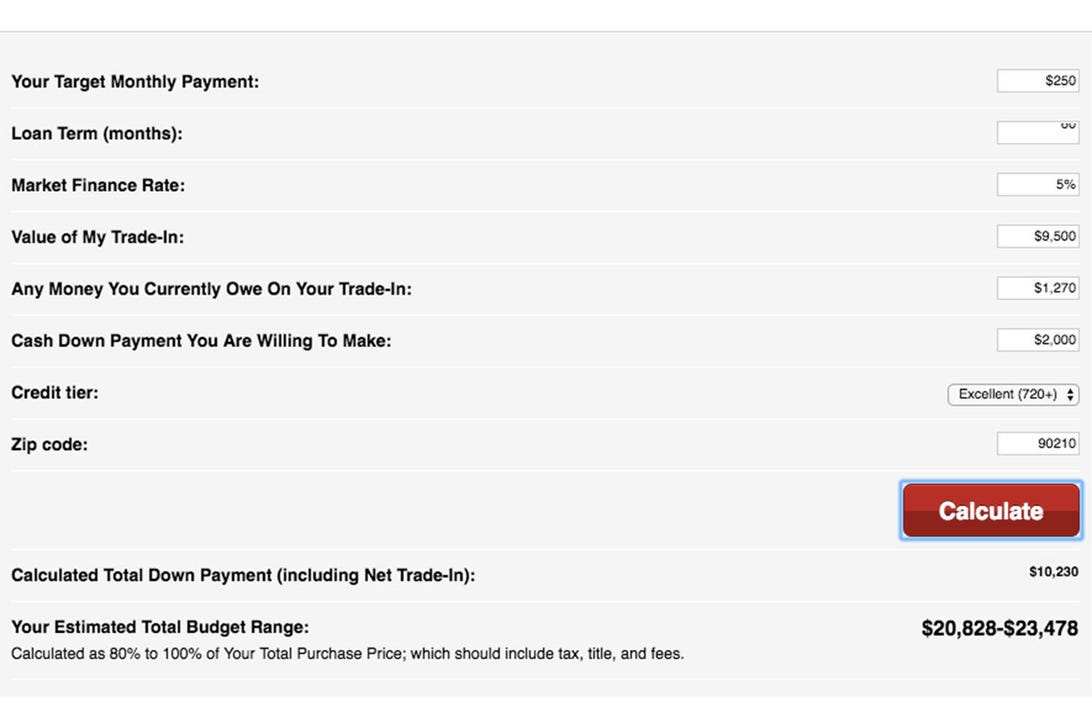

We've also got a loan calculator available on the Roadshow website. Enter how much you want to pay per month, as well as details like your expected loan length, interest rate and other details, and our calculator will help you figure out how much car you can afford to buy. You can also go the other way with our basic loan calculator, inputting a car's sale price and other data to figure an approximate monthly payment number.

Bear in mind that interest rates will vary considerably based on your credit history, down payment, and whether you finance through a carmaker directly, or through your bank or credit union. Rates remain generally low right now, but obviously, this can vary significantly from person to person.

You can use online calculators like this one from Roadshow to get an idea of how much you can spend per month.

Jake Holmes/RoadshowOther things to consider

There are more costs to owning a car than just the payment and insurance. You should also budget for how much you'll need to spend on gas and maintenance -- although a new car should be covered under warranty for most of a new-car loan period.

Also consider the length of your car loan. While longer loans will, in general, give you a lower monthly payment, you'll be paying more overall in interest charges. In addition, longer loans increase the amount of time you're "underwater" on the new car. That's the situation, known more formally as negative equity, when you owe more on your loan than the car is worth if it was sold. And that can make it more difficult to sell or trade-in the car.

Finally, don't forget that these guidelines can and should vary depending on your situation. If you don't drive very much, or spend a lot of your income on housing costs, you may prefer to spend less per month on your new car. If you're a car enthusiast, or need a very specific vehicle for your job or commute, you might want to stretch your budget a little higher. Overall for most people, spending 10% to 15% of your monthly take-home pay on a new car loan is a good guideline.

Climb in the driver's seat for the latest car news and reviews, delivered to your inbox twice weekly.

How Much Can You Finance on a New Car

Source: https://www.cnet.com/roadshow/news/new-car-buying-tips/

0 Response to "How Much Can You Finance on a New Car"

Post a Comment